Blog

GST invoices for all your B2B purchases and save up to 28% on Amazon Business

Indian Business Owners get GST invoices for all B2B purchases and they can save up to 28% on Amazon Business.

Share this

Amazon Business is an e-commerce platform tailored specifically for businesses, offering a wide range of products, bulk purchasing options, business-specific pricing, and features designed to streamline procurement processes for organizations of all sizes.

Why Should Indian Business Owner Create Amazon Business Account ?

Indian business owners should create an Amazon Business account to gain access to a vast selection of products, benefit from business-specific pricing and discounts, streamline procurement processes, enjoy convenient purchasing options, and ensure compliance with GST invoicing regulations, ultimately leading to cost savings, efficiency, and growth opportunities for their businesses. Indian Business Owners get GST invoices for all B2B purchases and they can save up to 28% on Amazon Business.

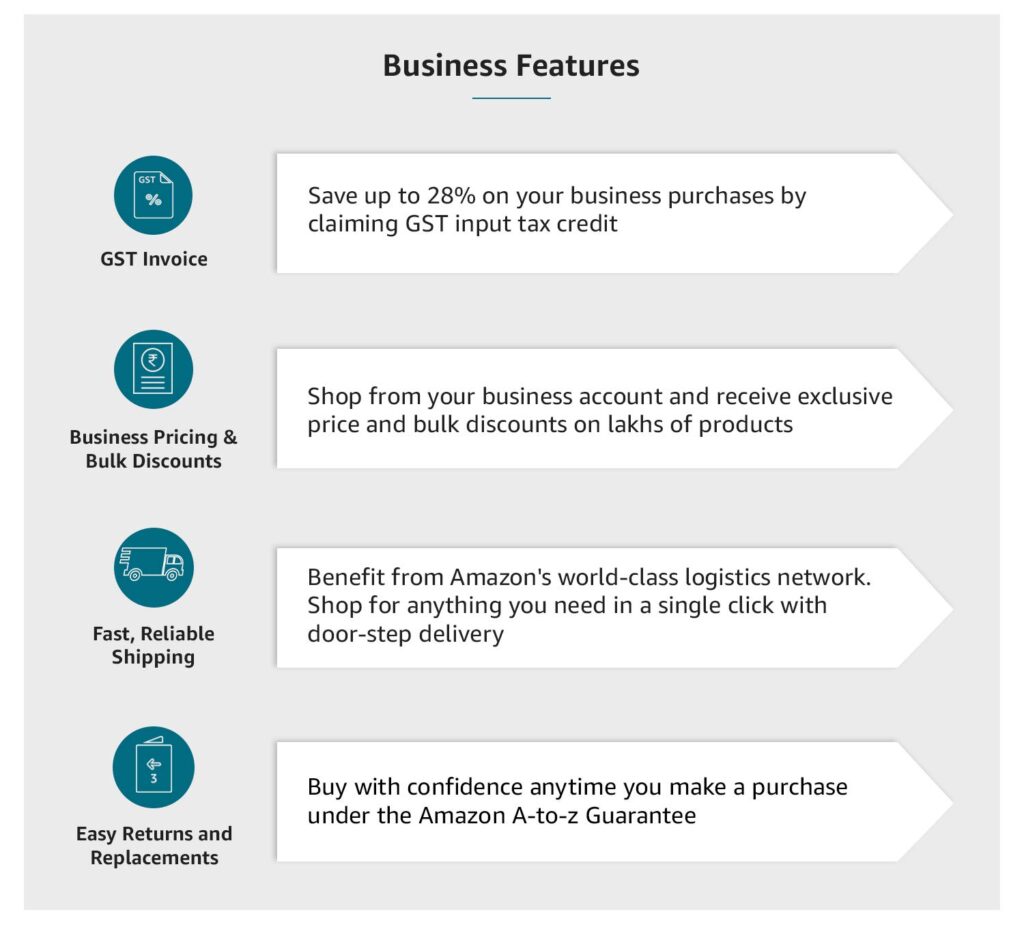

Benefits of Amazon Business Account

Benefits of an Amazon Business account for Indian businesses:

- Access to a wide range of products with exclusive business pricing and discounts.

- Simplified GST compliance with GST invoicing for all purchases.

- Streamlined procurement process with bulk purchasing options and convenient payment methods.

- Dedicated customer support tailored for Indian businesses.

- Business analytics tools for insights into purchasing patterns and cost-saving opportunities.

To Register Your Business on Amazon Business, Click Here

In Amazon Business, GST is included in product prices, making them transparent for business users. With a GSTIN, purchases are streamlined, ensuring easier tax management.

How to make amazon business account in India ?

To create an Amazon Business account in India:

- Visit Amazon Business India website. (Official Website)

- Click “Create a Free Account.”

- Provide business details including GSTIN.

- Agree to terms, verify details, and complete registration.

- Set up your account preferences.

- Start shopping for your business needs.

Navigating the world of GST invoicing for business purchases can be daunting. However, understanding its importance and how to leverage it can lead to significant savings and streamlined operations for your business. In this article, we’ll break down everything you need to know about GST invoicing, from its basics to practical tips for maximizing its benefits on platforms like Amazon Business.

Features of Amazon Business Account

Features of an Amazon Business account for Indian businesses:

- Exclusive business pricing and discounts.

- Bulk purchasing options with volume discounts.

- GST invoicing compliance for all purchases.

- Streamlined procurement processes.

- Dedicated customer support.

- Business analytics tools.

- Convenient payment methods.

- Extensive product selection.

To Register Your Business on Amazon Business, Click Here

What is GST Invoicing?

GST invoicing, or Goods and Services Tax invoicing, refers to the process of issuing invoices that comply with the regulations outlined in India’s GST regime. These invoices detail the goods or services supplied, including the corresponding GST amount charged. They are essential for businesses to claim input tax credit and ensure compliance with tax regulations.

To Create Amazon Business Account, Click Here

Why is GST Invoicing Important for Business Purchases?

GST invoicing is crucial for several reasons:

- Legal Compliance: Registered businesses are required by law to issue and receive GST-compliant invoices for taxable goods and services. Non-compliance can lead to penalties and legal issues.

- Input Tax Credit (ITC): Businesses can claim input tax credit only if they possess GST-compliant invoices. This credit helps offset the taxes paid on inputs, reducing the overall tax burden.

- Transaction Verification: GST invoices provide a record of business transactions, including details such as seller and buyer GSTINs, tax amounts, and supplied goods or services. They facilitate transaction verification and auditing.

- Record-Keeping: Proper maintenance of GST invoices is essential for accurate tax filing, accounting, and auditing processes. They serve as crucial documents for record-keeping and compliance.

To Register Your Business on Amazon Business, Click Here

Who Should Issue GST Invoices?

GST invoices should be issued by registered suppliers for taxable goods and services. However, there are exceptions and specific guidelines based on factors such as the supplier’s registration status and the transaction type.

Review from Indian Business man about Amazon Business

To Register Your Business on Amazon Business, Click Here

Key Features of GST Invoices:

To ensure that GST invoices are valid and eligible for input tax credit, they must include essential features such as:

- Supplier’s Information: Name, address, and GSTIN.

- Receiver’s Information: Name, address, and GSTIN.

- Invoice Number and Date.

- Place of Supply: For inter-state purchases, it should include the name of the place along with the state and code.

- HSN Code (for goods) or SAC Code (for services).

- Description, Quantity, Unit Price, and Total Value of Goods or Services.

- Taxable Value and Applicable GST Rate (CGST, SGST, UTGST, or IGST).

- Signature of the Supplier or Authorized Personnel.

How to Identify GST-Compliant Products for Business Purchases:

Platforms like Amazon Business offer tools to help businesses identify GST-compliant products:

- GST Filter: Enable the GST invoice filter to list products that come with GST-compliant invoices.

- GST Badge: Look for the GST invoice badge on product detail pages to confirm GST compliance.

- Check for Additional Information: Some products may have GST invoices available but may not offer GST tax credit. Ensure to check for any relevant notifications or disclaimers.

Create Amazon Business Account Here

Maximizing Benefits of GST Invoicing on Amazon Business:

Amazon Business streamlines the process of GST invoicing and offers several benefits for businesses:

- Ease of Filing Input Tax Credit: GST e-invoices make it easy for businesses to claim input tax credit, reducing overall tax liabilities.

- Significant Savings: Businesses can save up to 28% on purchases with GST-compliant invoices, leading to substantial cost savings.

- Streamlined Procurement: GST invoices simplify tax filing and auditing processes, ensuring compliance and efficient record-keeping.

- Legal Dispute Resolution: GST invoices serve as proof of transactions, aiding in resolving any legal disputes related to product quality or purchases.

Conclusion:

Understanding and leveraging GST invoicing is essential for businesses to ensure compliance, maximize savings, and streamline operations. Platforms like Amazon Business offer tools and features to simplify the process, making it easier for businesses to access GST-compliant products and enjoy the associated benefits. By following the guidelines outlined in this article, businesses can navigate GST invoicing with confidence and reap its rewards.

Share this

Blog

New Income Tax Bill 2025: Key reforms, tax slabs and benefits for Individuals and Businesses

Businesses will benefit from the tax rate reduction, which applies to start-ups and small and medium-sized enterprises (SMEs). Green investment incentives will encourage companies to adopt more sustainable practices.

Understanding the New Income Tax Bill 2025: Key Changes and Their Impacts

The new Income Tax Bill 2025 is expected to bring several tax-related amendments in India. The measure will completely change the way people, companies and organizations engage with tax authorities by focusing on simplicity, transparency and modernity. Several amendments in the bill will make the tax filing process easier and more efficient, allow the adoption of more equitable tax rates and promote economic growth by encouraging investment. This article will discuss the features of the program, the planned changes in the taxation structure and their potential impact on the economy.

What is the New Income Tax Bill 2025?

The new Income Tax Bill 2025 is a complete restructuring of the existing income tax regulations affecting Indian residents. The measure aims to simplify tax reporting, provide a more equitable tax system, and align the country’s tax policy with worldwide norms. The measure also aims to make it easier for middle-income families to do business, as well as promote social equality by reducing taxes and encouraging company compliance.

The government will aim to create a tax structure that is beneficial to the business community as well as serves the interests of businesses or taxpayers in the overall development of the country.

Key Features of the New Income Tax Bill 2025

Simplification of Tax Slabs:

The key features of the new Income Tax Bill 2025 include changes in the tax slabs for individual taxpayers. It aims to consolidate over five tax slabs and increase the income limit for which tax is paid. It also aims to provide relief to middle-income taxpayers so that the tax burden is reduced and there is no need to do complex calculations of taxes on different income types.

- Reduction in Tax Rates: The new bill proposes lower tax rates for middle-income earners, while introducing a few higher tax rates for high-income groups. The aim is to reduce the overall tax burden for the majority of taxpayers while still ensuring progressive taxation.

- Increased Tax Exemption Limit: The exemption limit for various tax deductions like 80C and 80D has been raised, enabling individuals to save more while reducing their tax liability.

Corporate Tax Reforms:

The new Income Tax Bill 2025 offers several corporate tax reforms to truly make India an attractive investment destination. These reforms focus on codifying the corporate tax system, reducing tax rates for companies, and encouraging foreign investment:

- Lower corporate tax rates: The bill seeks to reduce corporate tax for domestic companies to 22%, along with some additional incentives for small and medium enterprises.

- Special provisions for startups: The bill recognizes the growing role of economic activity driven by new startups operating in India. Along with this, it proposes tax exemptions during the early years of startups, allowing them to reinvest in their growth and contribute more to the overall economy.

- Incentives for green investments: The bill provides tax exemptions for any business investing in green technologies and renewable energy. This is in line with India’s commitment to reduce carbon emissions while promoting sustainable development.

Capital Gains Tax Reforms

Capital gains taxation has been a contentious issue for quite some time now. In the new Income Tax Bill 2025, reforms are proposed in the methods of taxation on long-term and short-term capital gains.

- Reduction in Capital Gains Tax Rates: The new bill proposes to reduce the tax rate on short-term and long-term capital gains on select assets like equities and real estate. This move is specifically targeted at promoting long-term investments which will lead to stability in the financial markets.

- Tax Exemptions for Long-Term Investments: With an aim to promote savings and investments in long-term capital gains, they introduce tax exemptions for assets like shares and mutual funds. This can really help the stock markets and attract more individual investors.

Tax Incentives for Digital Businesses

The rise of digital platforms and e-commerce has changed the way businesses operate. In this context, the new Income Tax Bill 2025 proposes to regulate taxation of digital businesses and e-commerce companies:

- Taxing foreign digital platforms: The Bill proposes to tax foreign digital companies such as international streaming platforms, social media services and e-commerce sites based on the revenues they earn in India. Such provisions should enable foreign companies to make their fair contribution to the Indian economy rather than benefiting from local taxation.

- Digital Filing System: To improve efficiency and add transparency, this bill makes it mandatory for all taxpayers, from businesses to individuals, to file their returns online from now onwards. With the advent of a completely online system, the need for cumbersome documentation for filing returns is expected to go away, as well as ease of settlement of refunds.

Tax Benefits for Green Investments

The new Income Tax Bill, 2025 is in line with India’s aspirations for environmental sustainability. This bill proposes tax incentives for individuals and companies investing in green technologies and renewable energy sources:

- Deduction for Investments in Renewable Energy: Individual and corporate investors in solar, wind and other forms of renewable energy sources will be entitled to tax deductions under the new bill.

- Incentives for Electric Vehicles: Tax exemptions will be offered to individuals and companies for the purchase and manufacturing of electric vehicles.

Improvements in the Tax Filing Process

Basically, the introduction of e-filing of taxes has been one of the major changes in the Indian tax system. The Income Tax Bill, 2025 includes a complete digital filing regime aimed at making the tax system efficient and transparent.

- Simplified process for filing: The digital filing system will result in greater accessibility by individuals or businesses and provide a more streamlined process that greatly reduces the chances of errors leading to delays.

- Reduced time for refunds and processing: The paradigm shift towards accepting digital returns is expected to reduce the processing time required to approve tax refunds, which has historically been a slow and cumbersome process.

Tax Rates on Cryptocurrencies and Digital Assets

With the continued interest in the difficulties, the new Income Tax Bill, 2025 should be considered to further look into the taxation of these emerging technologies.

- Taxation of cryptocurrency exchanges: Cryptocurrency trading will be subject to capital gains tax, which is applicable to all other forms of investment. This will shed a lot of light on the taxation of digital currencies and ensure that their traders pay appropriate taxes on their profits.

- Blockchain regulation: The bill lays out the framework for the regulation of blockchain-based businesses, how they will be taxed, and the compliance requirements they will need to follow.

Impact on Taxpayers and Businesses

For Individual Taxpayers

The new 2025 income tax bill is expected to benefit middle-class taxpayers by lowering tax rates and granting higher exemptions. Tax exemption limits for individuals will be increased, allowing for additional savings while maintaining a simplified tax system that is easier to understand and comply with. Additionally, these incentives to invest in green technology, healthcare, and education will help people minimize their tax liabilities while also pursuing a path toward a more sustainable economy.

For Businesses

Businesses will benefit from the tax rate reduction, which applies to start-ups and small and medium-sized enterprises (SMEs). Green investment incentives will encourage companies to adopt more sustainable practices. In addition, taxing foreign digital platforms and adopting e-filing would help level the playing field and improve compliance in a systematic way.

The new Income Tax Bill 2025 represents a major restructuring of the tax structure in India. As this legislation proposes to simplify the tax code, reduce rates, encourage long-term growth and ease compliance for both individuals and businesses, it will also substantially strengthen the position of the taxpayer, promote green investments and create a more efficient and business-friendly environment.

As the Bill progresses through the rules of Parliament, all individuals and businesses will be made aware of the details of its features and potential impacts on financial planning. Early adaptations will ensure that taxpayers can access and enjoy the benefits of the new tax structure.

Blog

Get Quillbot Premium at Rs 130 or 2 USD Only: Use all Premium features of Quillbot Premium for a Month at lowest Price

The official Quillbot Premium subscription costs Rs 7,000 per year (~$90/year). With our group-buy model, you get the same premium access for just Rs 650/8 USD per Year or Rs. 130/2 USD per month – saving you over 80%!

Get QuillBot Premium at the best price and improve your writing instantly!

Looking for a powerful AI writing assistant that can paraphrase, summarize, and improve your work seamlessly? QuillBot Premium is designed to boost your productivity and improve your writing skills, all at an incredible price!

For just Rs. 130 or 2 USD, you can have full access to QuillBot Premium, which includes unlimited paraphrasing, summarizing, and grammar correction on PC and mobile, as well as a commercial license.

Download Now

Why Choose Quillbot Premium Subscription from Us?

- AI-powered writing assistant – Improve your sentence structure, grammar, and clarity.

- Unlimited paraphrasing – Create new material while keeping the original meaning.

- Advanced summarization – Turn long content into concise, easy-to-read summaries.

- Improve your writing skills with AI-powered grammar and style tips.

- Works on all devices – Web-based, compatible with PC, Mac, iOS, and Android.

- Lowest price guarantee – Enjoy QuillBot’s premium features at a low price!

- Choose from flexible monthly, semi-annual, or annual plans.

Who Should Get Quillbot Premium?

- Students can improve their writing, avoid plagiarism, and make progress on their research papers.

- Bloggers and writers can develop engaging pieces that are easier to read and understand.

- Content creators and marketers can create high-quality material faster while improving their SEO writing.

- Freelancers and business professionals can improve their email correspondence, reports, and presentations.

- Researchers and journalists can summarize articles and papers in a few seconds.

Why Pay More for Quillbot? Get the Same Features for Less!

The official Quillbot Premium subscription costs Rs 7,000 per year (~$90/year). With our group-buy model, you get the same premium access for just Rs 650/8USD per Year or Rs. 130/2USD per month – saving you over 80%!

✔ Same AI-Powered Features

✔ Same Unlimited Usage

✔ Same Web-Based Access

✔ Huge Savings – No Risk!

How to Get Quillbot Premium at lowest Price for Just ₹ 130 or 2 USD?

- Choose your plan: You can subscribe monthly, every six months, or annually.

- Add to Cart: Click “Buy Now” to complete your order.

- Make a secure payment: Use a trusted payment method.

- Receive login details: Access your account quickly by email.

- Start writing smarter: Get unlimited help to write easily.

What You Get Upon Purchase of Quillbot Premium from US

- Genuine QuillBot Premium subscription with unlimited access to paraphrasing and summarizing tools.

- AI-powered advanced grammar and writing improvements.

- Web-based access from any device

- Instant activation and customer support.

FAQs about QuillBot Premium at the best price

Ques: Is this a valid QuillBot Premium subscription?

Ans: Yes! This is an actual QuillBot Premium membership available through bulk purchase, making it more affordable.

Ques: Can I access QuillBot Premium on my mobile device?

Ans: Absolutely! QuillBot works perfectly on all platforms including PC, Mac, iOS, and Android via the web.

Ques: How long will it take to activate my subscription?

Ans: Activation usually happens within a few minutes or hours after payment confirmation.

Ques: Will I have access to all premium features?

Ans: Yes! You’ll get unlimited paraphrasing, summaries, grammar corrections, and more.

Ques: Can you renew my subscription?

Ans: Yes! You can renew your membership at the same reduced cost to maintain your access.

Get QuillBot Premium for just Rs 130 or 2 USD and stop struggling with writing.

Why struggle with writing when smart AI can improve your clarity, accuracy, and creativity? Subscribe today to get QuillBot Premium at the best price!

👉 Get your subscription now!

Blog

Envato Elements Unlimited Downloads – Get Everything for Just ₹1,499 or 20 USD!

Envato Elements annual Subscription costs Rs 16,500 (approx. $198). Our Shared Account Access approach offers the same access for just Rs 1,499 – a fraction of the original cost!

Get Envato Elements with unlimited downloads at the lowest price ever!

Our Envato Elements unlimited downloads Package allow you to develop and progress with fantastic tools and innovative suggestions – none of which can replace the others in terms of price.

Envato Elements offers stock images, graphics, designs, fonts, films and more for Just Rs 1,499 or 20 USD, including a commercial license.

Download Now

Why Choose Our Envato Elements Subscription?

- Unlimited Downloads – Get unlimited access to millions of creative materials.

- Web access : It is seamless across all platforms including PC, Mac, iOS, and Android (no software installation required).

- Commercial License – Use downloaded materials for commercial and client projects.

- Lowest Price Guarantee – Save with our affordable subscription option.

- Flexible Plans Available – Choose from monthly, semi-annual, or annual options based on your requirements.

Who Should Get Envato Elements?

- Graphic designers and creatives can easily find professional design templates, mockups, and illustrations.

- Video editors and cinematographers can download unlimited stock footage, motion graphics, and sound effects.

- Content creators and marketers can create visually appealing posts, presentations, and websites for social media.

- Freelancers and agencies can work efficiently with premium design resources.

Why Pay More for Envato Elements when you can Get the Same Features for Less!

Envato Elements annual Subscription costs Rs 16,500 (approx. $198). Our Shared Account Access approach offers the same access for just Rs 1,499 or 20 USD– a fraction of the original cost!

- ✔ Enjoy all premium features

- ✔ Unlimited downloads

- ✔ Commercial license included

- ✔ Significant savings with no risk!

How to Get Envato Elements for Just ₹1,499 or 20 USD?

- Select your Subscription plan: Monthly, Semi-annual, or Annual.

- Add to Cart: Click “Buy Now” to complete your order.

- Make a secure payment: Use a trusted payment method.

- Receive login details: Access your account quickly via email.

- Start downloading and enjoy endless creative materials.

What You Get Upon Purchase of Envato Elements Package from us

- ✔ 100% Genuine Envato Elements Subscription

- ✔ Unlimited Downloads with a Commercial License

- ✔ Web-Based Access on Any Device

- ✔ Instant Activation & Customer Support

Customer Reviews & Testimonials on Envato Element Package Bought from us

⭐ Rekha Mohanty – ⭐⭐⭐⭐⭐

- As a designer, I use Envato Elements every day. This cost-saving strategy has saved me hundreds of rupees!

⭐ Sarita Kumari – ⭐⭐⭐⭐⭐

- “This is the best discount I’ve found on Envato Elements. Unlimited downloads and seamless access! in just Rs 1499”

⭐ Amit Jaiswal – ⭐⭐⭐⭐⭐

- What a nice price! I received full access for a fraction of the original price. Highly recommended!”

Thousands of satisfied users have already subscribed – don’t miss this limited-time offer!

Frequently Asked Questions on Envato Elements in just Rs 1499 or 20 USD

Ques: Is this the right Envato Elements subscription?

Ans: Yes! This is a legitimate Envato Elements subscription offered in Shared Account basis Subscription to save your money.

Ques: Can I access Envato Elements from my phone?

Ans: Yes! Envato Elements can be accessed online from any device (PC, Mac, iOS, Android).

Ques: How long does activation take?

Ans: Payment confirmation may take several minutes, Then we will share the credentials over mail.

Ques: Can I use Envato downloaded Elements in commercial projects?

Ans: Definitely. The commercial license allows you to use assets for both professional and client projects.

Ques: Can I renew my Envato Elements subscription?

Ans: Yes! You can renew your Subscription at the same discounted rate to continue access.

Start your creative journey with Envato Elements for just Rs 1,499!

Why pay more when you can get endless premium resources at the lowest price? Subscribe today to unleash your creative potential!

👉 Get your subscription now!

-

Blog11 months ago

Blog11 months agoBSEB बिहार बोर्ड Class 10 and 12 Compartment परीक्षा Date Sheet जारी: Check Here

-

Education1 year ago

Education1 year agoYour Complete Guide to Sainik School Admission

-

Blog2 months ago

Blog2 months ago2025 में शब-ए-बारात कब है? जानें तिथि, महत्व और परंपराएं

-

Education11 months ago

Education11 months agoIB ACIO टियर I परिणाम 2024 जारी, योग्य उम्मीदवारों की सूची के लिए Direct लिंक

-

Blog12 months ago

Blog12 months agoTop 10 Romantic Asian Dramas of All Time That Will Sweep You Off Your Feet

-

Blog1 year ago

Blog1 year agoIndian Girls Masturabate Regularly? Why they Should embrace Masturbation ?

-

Business11 months ago

Business11 months agoमहिंद्रा ने सिंगल चार्ज पर 450 किलोमीटर चलने वाली इलेक्ट्रिक SUV XUV700 (XUV.e8) लॉन्च किया!

-

Blog2 years ago

Blog2 years agoप्यार का बुखार: यह कैसे होता है? इन 5 संकेतों की तलाश करें, ज्यादातर लोगों को सही उत्तर नहीं पता होगा